7 Ways You're Hurting Your Kids Financially

After all of the sleepless nights and difficulties you’ve experienced with your child, I’m sorry to tell you that your job isn’t over. Just as important as the task of making your child’s life comfortable when they are little, every parent's dream is of a good future for their children. It is always a top priority to protect and provide for your child’s needs. Maybe you are one of those parents who save money for your child’s future. But you might be surprised that if there’s someone dooming your child’s financial future, it’s YOU.

Before you reach that stage, wondering how and where you went astray, below are 7 ways you might be sabotaging your child’s future finances; good things to think about today.

1. Not talking about money

The fewer conversations you have with your children about money, the more they will not truly understand the value of it. It is said that not talking to your children about money is one of the worst parenting mistakes you can make. The possible result, when they grow up, is that your child is uncertain or doesn’t have a firm grasp on how to handle their own finances.

Even if it seems uncomfortable to have a detailed money and finances discussion now, at least make an effort to educate them on basic personal finance skills, like not spending more than you are taking in and how to establish a budget. That will help them avoid debt and low credit scores in the future.

2. Being a poor example

Parents are the role model of their children’s behavior. You might not think they are paying attention, but the are. When it comes to finances, you are their first example of what to do and not do. How you handle your finances can greatly influence your children. Actually, most parents know that they should be a good financial role model but many aren’t. Why?

It’s the old, do as I say, not as I do… Or in other words, you give great advice to your children but you, yourself go down a different path. In that case,what do you expect to happen to your children when they handle their finances? Your actions will always speak louder than your words, so take heed. Otherwise, our children will naturally follow in your footsteps.

3. Hiding your arguments over money

While there are a lot of things a couple shouldn’t argue about in front of their children, arguing (or should I say, having an earnest discussion) over money in front of them could be beneficial. Instead of making them believe that the family’s financial situation is good, let them know the truth, because in reality, financial disagreement occurs in every healthy and loving relationship. When people disagree, and then find a solution, it is a great life lesson on issues that come up, and finding resolutions, even when money and spending is the topic. This ultimately will provide your children with confidence when dealing with money issues.

4. Using cards instead of cash

The most convenient and fastest way to pay for anything is by using a card. Sounds so magical right? When raising kids, it’s better to use cash to purchase something. In that way, they will understand and see in their own eyes that you are paying with real money that came from your own pocket. This will avoid a dangerous mentality to the kids that the magical plastic card can buy anything easily and almost endlessly. It also instills the value of not overspending and over-extending.

5. Not clarifying WANTS versus NEEDS

A need is a necessity or something essential while a “want” is a desire for something. When you're inside a mall and your child asks for something, is it a need or a want? It is very important for parents to know the difference between the two because whatever decision you make will influence them as they grow.

6. Not providing an allowance

No matter how much you want your kids to be comfortable, you need to avoid giving them cash on as-needed-basis. Children should receive an allowance. It will help them learn how to properly budget and prioritize spending the money they have on the most important things. Having an allowance, saving and wisely spending, is a learning process that is a huge valuable life lesson.

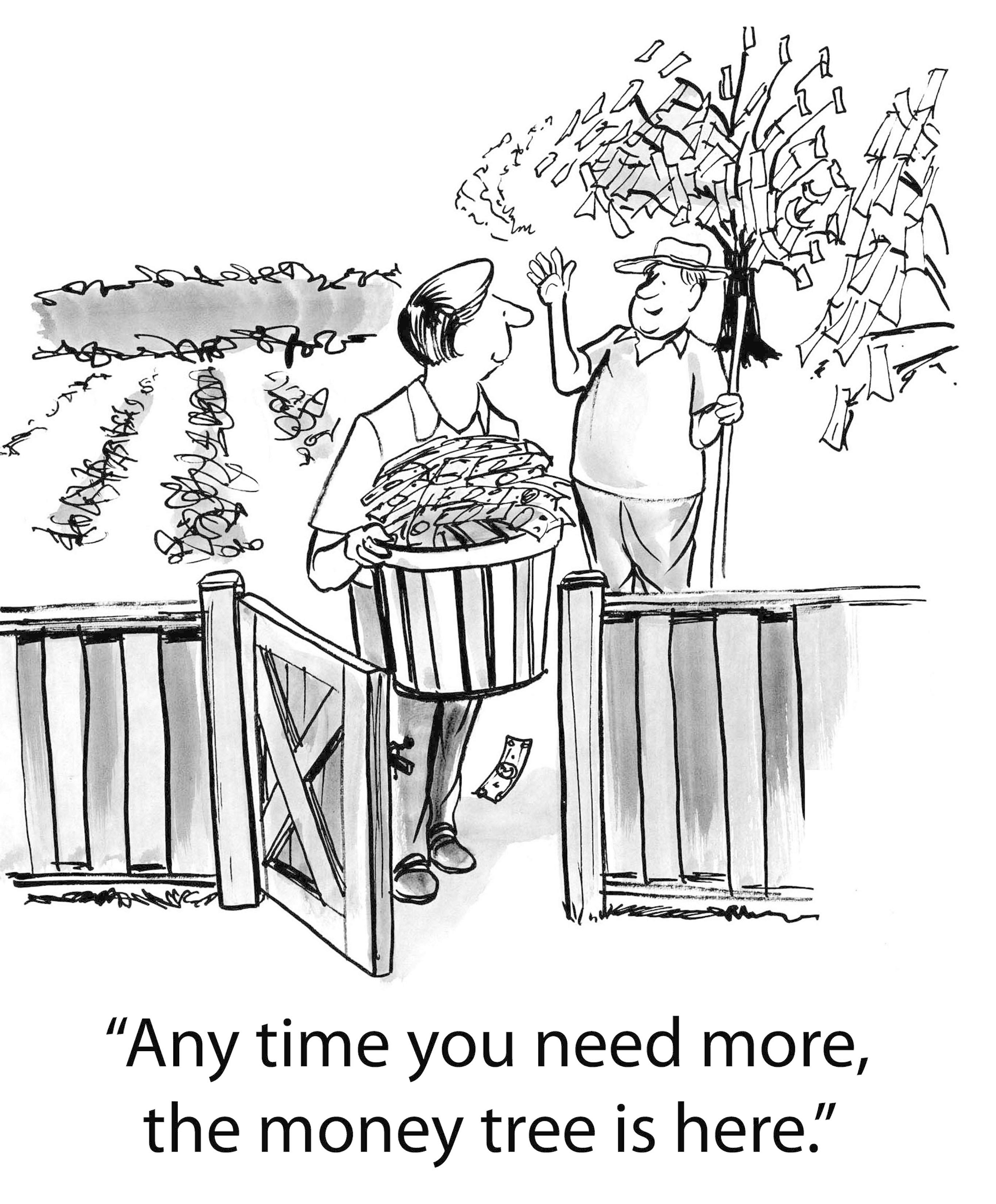

7. Supporting adult children

Providing too much financial support for your children can make them dependent on you. You should recognize when to stop so that your children will learn how to have financial independence.

Parenting is certainly not easy. Providing your children with a good financial education is one of the most important things you can do in preparing your children to be responsible adults.

Posted in Blog on Apr 06, 2016

Subscribe to newsletter

Got questions? Ask them!

Related posts

- New FAFSA changes can make applying for financial aid easier

- Is using your retirement to pay for your kids' education wise?

- Guide for parents with college bound kids

- Basic Indispensable Skills for Back to School Moms

- College Level Examination Program (CLEP) exams are now available at CalCAH